Equal Protection for Your Legacy: How Life Insurance Secures Your Family's Future

Equal Protection for Your Legacy: How Life Insurance Secures Your Family's Future

Photo by Albert Vincent Wu on Unsplash

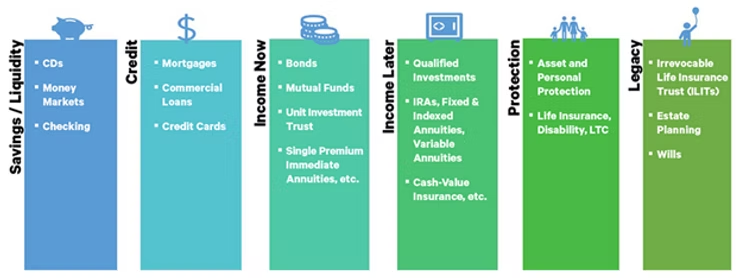

Introduction to Life Insurance Products

As a member of an affluent family, you understand the importance of protecting your legacy and ensuring the financial well-being of your loved ones. In today's fast-paced world, it's essential to have a comprehensive financial plan in place, and life insurance is a crucial component of that plan. According to a recent survey, 70% of affluent families consider life insurance a key component of their financial planning strategy. This is because life insurance provides a safety net for your family, ensuring that they are protected from financial uncertainty in the event of your passing.

In the words of Warren Buffett, "Price is what you pay. Value is what you get." When it comes to life insurance, the value lies in the peace of mind that comes with knowing your loved ones are protected. A well-structured life insurance policy can provide a tax-free death benefit to your family, ensuring that they can maintain their lifestyle and achieve their long-term goals. For instance, a term life insurance policy can provide coverage for a specific period, such as 10 or 20 years, while a whole life insurance policy can provide lifetime coverage.

Photo by McGill Productions on Unsplash

The Evolution of Life Insurance

Life insurance has come a long way since its inception. In ancient Rome, for example, burial clubs were formed to provide financial assistance to families in the event of a loved one's passing. Today, life insurance is a sophisticated financial product that can be tailored to meet the unique needs of affluent families. With the rise of digital technology, it's now easier than ever to purchase and manage life insurance policies online.

However, with so many options available, it's essential to have expert guidance to navigate the complex world of life insurance. This is where Moore Money Health and Life comes in – our team of experienced professionals can help you create a personalized life insurance plan that aligns with your overall financial goals.

Photo by Natalia Olivera Amapola on Pexels

The Importance of Expert Guidance in Financial Planning

Expert guidance is crucial when it comes to financial planning, especially for affluent families. A financial advisor can help you create a comprehensive plan that takes into account your unique needs, goals, and risk tolerance. When it comes to life insurance, expert guidance can help you avoid common pitfalls and ensure that your policy is tailored to meet your specific needs.

For example, a financial advisor can help you determine the right amount of coverage, choose the right type of policy, and ensure that your beneficiaries are properly designated. They can also help you integrate your life insurance policy with your overall financial plan, including your investments, retirement accounts, and estate plan.

Photo by energepic.com on Pexels

The Benefits of Expert Guidance

So, what are the benefits of expert guidance when it comes to life insurance? For starters, a financial advisor can help you:

Avoid common pitfalls, such as underinsuring or overinsuring

Choose the right type of policy, such as term life or whole life

Ensure that your beneficiaries are properly designated

Integrate your life insurance policy with your overall financial plan

Review and update your policy regularly to ensure it remains aligned with your changing needs

In addition, expert guidance can provide you with peace of mind, knowing that your life insurance policy is in good hands. As the saying goes, "A stitch in time saves nine." By working with a financial advisor, you can avoid costly mistakes and ensure that your life insurance policy is working for you, not against you.

Key Considerations for Selecting Life Insurance as an Affluent Family

As an affluent family, there are several key considerations to keep in mind when selecting life insurance. These include:

Wealth protection: Life insurance can provide a tax-free death benefit to your loved ones, ensuring that they can maintain their lifestyle and achieve their long-term goals.

Family legacy: Life insurance can help you leave a lasting legacy for your family, providing them with the financial resources they need to achieve their goals and pursue their passions.

Financial security: Life insurance can provide a safety net for your family, ensuring that they are protected from financial uncertainty in the event of your passing.

Expert guidance: Working with a financial advisor can help you create a personalized life insurance plan that aligns with your overall financial goals.

The Importance of Family Legacy

As an affluent family, your legacy is important to you. You want to leave a lasting impact on the world and provide your loved ones with the financial resources they need to achieve their goals and pursue their passions. Life insurance can help you achieve this goal, providing a tax-free death benefit to your beneficiaries and ensuring that your legacy lives on.

In the words of Nelson Mandela, "The greatest glory in living lies not in never falling, but in rising every time we fall." As an affluent family, you understand the importance of rising above challenges and achieving greatness. Life insurance can help you do just that, providing you with the peace of mind that comes with knowing your loved ones are protected.

Conclusion

In conclusion, life insurance is a crucial component of any comprehensive financial plan, especially for affluent families. With the right guidance and expertise, you can create a personalized life insurance plan that aligns with your overall financial goals and provides your loved ones with the financial security they need to thrive. At Moore Money Health and Life, our team of experienced professionals is dedicated to helping you achieve your financial goals and protect your legacy. By working together, we can create a brighter future for you and your loved ones.