Unlock Wealth with Self-Directed IRA Real Estate Investing

Unlock Wealth with Self-Directed IRA Real Estate Investing

Investing in real estate has long been regarded as one of the most lucrative ways to build wealth. However, many investors overlook the unique opportunity provided by a self-directed Individual Retirement Account (IRA). By using a self-directed IRA for real estate investing, you can unlock a powerful avenue for wealth growth while enjoying significant tax benefits.

IRA Real Estate Investing: A Path to Financial Freedom\

Self-directed IRAs allow individuals to have control over their investment choices, including real estate. This flexibility is crucial because it opens the door to investment opportunities that traditional IRAs often ignore. With a self-directed IRA, you can purchase residential, commercial properties, land, and even real estate notes, giving you a broader range of investment options.

One of the most compelling reasons to consider IRA real estate investing is the potential for significant returns. According to a study from the National Association of Realtors, real estate has consistently shown an appreciation rate of about 3.5% to 5% per year, surpassing inflation and contributing positively to your investment portfolio. This appreciation combined with rental income can create a powerful stream of income that can help grow your retirement savings.

Modern residential property often seen in real estate investments.

The Benefits of Self-Directed IRA Real Estate Investment

Using a self-directed IRA for real estate investing comes with a range of benefits:

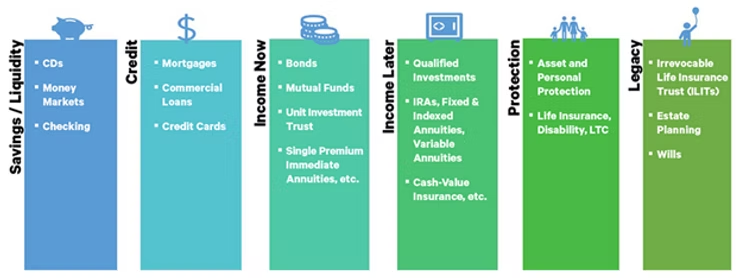

- Tax Advantages: Investments made through a self-directed IRA grow tax-deferred. This means that you won't pay taxes on your rental income or property appreciation until you withdraw funds from your account during retirement. Alternatively, if you choose a Roth IRA, you can withdraw your profits tax-free in retirement after paying taxes on your initial contributions.

- Diversification: Real estate allows for asset diversification. By investing in property, you can hedge against stock market volatility. As uncorrelated assets, real estate often performs differently from stocks and bonds, which helps to stabilize your portfolio.

- Potential for High Returns: Rental properties can generate passive income while also appreciating in value. This dual benefit can significantly enhance your overall returns compared to traditional investment methods, especially if you choose properties in emerging markets.

- Control Over Investments: Unlike traditional IRAs, where your investments are typically limited to stocks, bonds, and mutual funds, self-directed IRAs empower you to choose your own investments, allowing for a tailored approach that aligns with your financial goals.

A well-designed kitchen in a rental property ready for tenants.

Getting Started with Self-Directed IRA Real Estate Investing

To begin investing in real estate through a self-directed IRA, follow these essential steps:

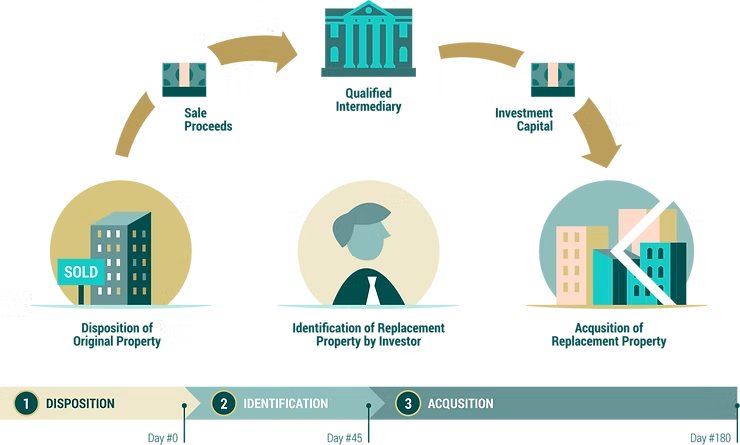

- Choose a Custodian: The first step is to select a custodian or trustee who specializes in self-directed IRAs. Make sure they are experienced in real estate transactions to help guide you through the process.

- Fund Your IRA: You can transfer existing retirement funds into your new self-directed IRA. This can often be done without tax penalties if done correctly. Make sure to verify with your custodian.

- Identify Investment Opportunities: With your self-directed IRA funded, you can start searching for real estate opportunities. Be diligent in your research; investigate property locations, market trends, and potential earnings.

- Make the Purchase: Once you identify a property, your custodian will help you navigate through the purchasing process. Remember, all transactions must be conducted within the self-directed IRA, and it's vital to remain compliant with IRS regulations.

- Manage Your Investment: Your custodian can also assist with property management decisions. However, keep in mind that you can’t manage the property yourself if it’s held in an IRA. All income generated must go back into your IRA, which can then be reinvested or withdrawn during retirement.

A view of a dynamic real estate market with numerous properties available.

Common Challenges in Self-Directed IRA Real Estate Investing

While the benefits of investing in real estate through a self-directed IRA are undeniable, there can be challenges:

- Complex Regulations: The IRS has strict rules governing self-directed IRAs. There are prohibited transactions, such as buying properties from family members or using the property for personal use. Failing to adhere to these regulations can lead to hefty penalties.

- Lack of Liquidity: Real estate is typically less liquid than stocks or bonds. If you need to access your cash quickly, selling real estate may take longer and involve significant transaction costs.

- Out-of-Pocket Expenses: Any maintenance or improvement costs must be paid from your IRA funds, not from personal funds. This can affect your cash flow if not planned accordingly.

- Market Risks: Like any investment, real estate values can decline. Market factors such as economic downturns or local market issues can affect property values and rental income.

Strategic Tips for Successful Self-Directed IRA Real Estate Investing

To maximize your success in self-directed IRA real estate investing, consider these crucial strategies:

- Conduct Thorough Research: It’s essential to investigate market trends, neighborhood developments, and other indicators of property value before investing. Leverage online tools and local real estate market reports for informed decision-making.

- Diversify Your Real Estate Investments: Don't limit yourself to a single type of property. Consider diversifying across different types of real estate—residential, commercial, or even vacation rentals—to balance the risks.

- Use Professional Guidance: Surround yourself with professional advisors experienced in self-directed IRAs and real estate. Attorneys, accountants, and real estate agents can provide invaluable insights and help navigate complex transactions.

- Understand the Risks: Always assess the risks associated with any investment. Ensure that you are comfortable with the potential downsides and develop a risk management plan to address them.

By adopting these strategies and remaining vigilant about the regulations governing your investments, you can significantly increase the odds of achieving long-term success.

Unlocking Your Wealth Potential

Self-directed IRAs open up a new world of investment possibilities, especially when it comes to real estate. By understanding how to manage your self-directed IRA for real estate investing effectively, you can enhance your wealth over time, secure your retirement, and achieve financial independence.

If you're considering a more hands-on approach to your retirement savings, a self-directed IRA could be the perfect vehicle. For more information on how to get started with self-directed ira real estate, explore resources and connect with a professional custodian today.

The realm of real estate offers numerous opportunities to foster your long-term financial growth. Start your journey to financial freedom with the actionable steps outlined above and watch as your wealth flourishes without the constraints of traditional investment vehicles.