Real Estate Tax Advantages: Occupational Therapists Understanding Deffered Capital Gains

Real Estate Tax Advantages: Occupational Therapists Understanding Deffered Capital Gains

Real estate isn’t just about location, location, location—it’s about strategy, leverage, and real estate tax planning. Investing in multifamily properties, serves as a great way to generate wealth and that is more stable that other investment opportunities. From deductions on mortgage interest to the ability to defer capital gains, real estate investments provide layers of tax perks.

The true brilliance of RE investment lies not in the predictable flow of real estate passive income, but in its multi-dimensional tax advantages. Multifamily investors don’t just benefit from what they earn in distributions, they benefit from what they save.

The 1031 exchange is the stealthy magician of the real estate world. With a wave of its regulatory wand, it makes capital gains tax deferral—at least for the time being. Named after the Section 1031 of the Internal Revenue Code, this strategy allows investors to sell a property and reinvest the proceeds into a “like-kind” property, all while deferring the capital gains taxes they would otherwise owe. It’s a game of chess in the world of taxes, and for industrial and commercial real estate investors, it’s a checkmate move.

The power of the 1031 exchange is that it enables continuous reinvestment without interruption. Normally, selling a property triggers a capital gains tax liability, reducing the cash you can reinvest. But with a 1031 exchange, you defer that tax, keeping more capital working for you. This creates a compounding effect—as you upgrade from one property to the next, your wealth can grow while the tax man is kept waiting at the door.

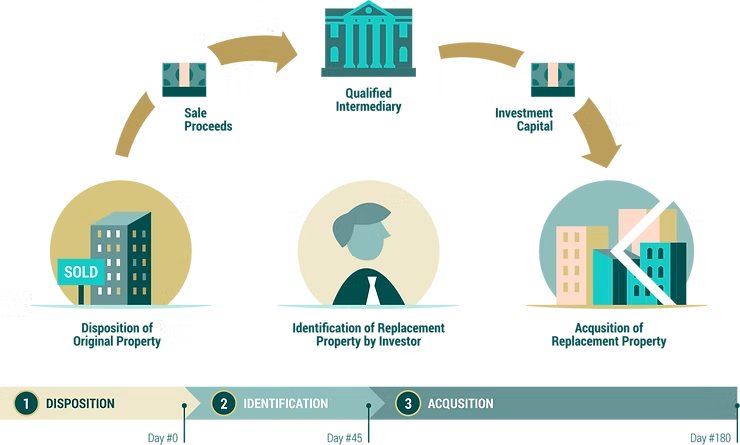

However, the 1031 exchange isn’t a casual transaction—it requires precision and timing. Here’s the play-by-play:

- Sell the Property: First, you sell your existing property. Easy enough, right? But here’s where it gets interesting.

- Identify a Replacement: Within 45 days of selling, you must identify potential “like-kind” replacement properties. This doesn’t mean they have to be identical, but they must be similar enough in nature—so a single family home can be swapped for a multifamily property, but not for a luxury yacht.

- Complete the Purchase: You have 180 days to close the deal on your new property. Time is ticking, and if you miss this window, you’re back to square one, with capital gains taxes staring you down.

This strategy is particularly valuable for commercial investors. Imagine an investor selling a 10 unit property then by using a 1031 exchange, they can reinvest the proceeds into a larger property without being burdened by capital gains taxes. The result? They continue scaling operations while keeping their wealth compounding, untaxed, and poised for future growth.

The Infinite Deferral

The magic of the 1031 doesn’t end with a single swap. Investors can use this strategy over and over again, exchanging one property for another in a perpetual game of real estate musical chairs, continually deferring taxes. Uncle Sam doesn’t get paid until the music stops—if it ever does.

For smart real estate investors, the 1031 exchange is a ticket to building a massive real estate empire while keeping capital gains taxes in a permanent state of limbo. The result? A portfolio that grows tax-deferred, enabling reinvestment and wealth generation on an impressive scale.

Moore Money Capital is here to help you defer taxes and grow your wealth. Contact us today for our latest opportunties.